India Hikes PLI Budget for FY2025-26 to Boost Growth in Key Sectors

- matslind

- Mar 10, 2025

- 3 min read

India is set to increase its domestic manufacturing capabilities for the fiscal year 2025-26. The central government has increased budgetary allocation under the Production-Linked Incentive (PLI) scheme for specific sectors.

With this hike, the central government aims to accelerate industrial growth by attracting investment, enhancing production capacity, and creating job opportunities.

On March 3, 2025, India’s central government announced its decision to increase the budget size of several key sectors covered within the flagship PLI scheme. As per the official announcement, sectors such as automobiles, IT electronics, and textiles have witnessed substantial hikes in allocation, a strategic move to bolster the industry’s production capacity.

This move aims to reduce India’s reliance on imports and boost exports, ultimately strengthening the country’s position in the global market and reducing import dependence.

PLI budget increase to boost key sectors

Among the major beneficiaries, the electronics and IT hardware sector has seen its budget increase from INR 57.77 billion (US$662 million) (FY 2024-25 revised estimate) to INR 90 billion (US$1.03 billion), highlighting India’s push for self-sufficiency in technology manufacturing. The automobile and auto components industry, a crucial sector for India’s industrial landscape, has received a jump in allocation from INR 3.46 billion (US$39.65 million) to INR 28.18 billion (US$322.9 million). The textile sector has also been a major recipient of additional PLI funding, with its allocation surging from INR 450 million (US$5.15 million) to INR 11.48 billion (US$131.5 million), supporting India’s vision to establish itself as a leading textile hub globally.

Sector-wise Budget Allocation Under PLI Scheme for FY 2025-26 | ||

PLI scheme | Revised estimates FY 2024-25 | Budget estimates FY 2025-26 |

PLI for electronics manufacturing and IT hardware. | INR 57.77 billion (US$662 million) | INR 90 billion (US$1.03 billion) |

PLI for automobiles and auto components | INR 3.46 billion (US$39.65 million) | INR 28.18 billion (US$322.9 million) |

PLI for pharmaceuticals | INR 21.50 billion (US$246.3 million) | INR 24.44 billion (US$280 million) |

PLI for textile | INR 450 million (US$5.15 million) | INR 11.48 billion (US$131.5 million) |

PLI for white goods (ACs and LED Lights) | INR 2.13 billion (US$24.4 million) | INR 4.44 billion (US$50.8 million) |

PLI for specialty steel | INR 550 million (US$6.3 million) | INR 3.05 billion (US$34.9 million) |

PLI for national programme on Advanced Chemistry Cell (ACC) battery storage | INR 154.2 million (US$1.76 million) | INR 1.55 billion (US$17.76 million) |

The increased funding aligns with the broader objective of enhancing India’s global competitiveness, attracting more foreign investments, and expanding local production capabilities.

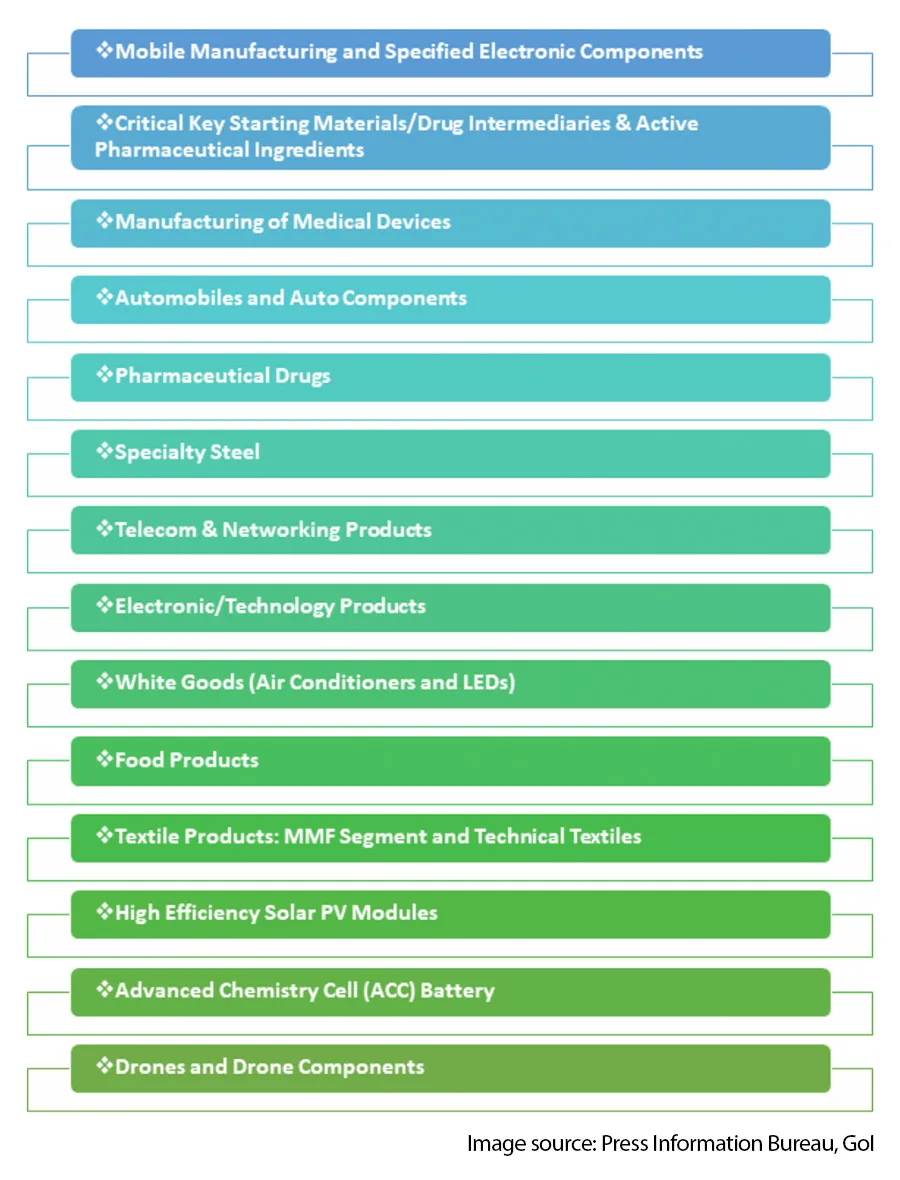

The PLI scheme was first launched in 2020 and, as of 2025, includes 14 sectors within it. As per the central government, as of August 2024, the cumulative investments in the target sectors have reached INR 1.46 trillion (US$16.06 billion). It is estimated that investments will surpass INR 2 trillion (US$23 billion) in the coming year, fueling India’s employment scenario as well.

Increasing India’s production and export capabilities

One of the primary objectives of the PLI scheme is to strengthen India’s manufacturing base, boost exports, and reduce dependency on imports, particularly from neighboring countries such as China. The scheme incentivizes domestic manufacturers to localize production and establish globally competitive supply chains. According to the central government, as of August 4, 2024, sectors such as electronics, pharmaceuticals, and food processing have witnessed a significant rise in exports under the PLI scheme, with total exports surpassing INR 4 trillion (US$45.83 billion).

Enhancing India’s global trade performance through PLI

India is also leveraging the PLI scheme to attract foreign direct investment (FDI) by fostering an investor-friendly policy framework. The introduction of a liberalized FDI policy, particularly in manufacturing, telecom, and insurance, has played a pivotal role in increasing capital inflows. FDI equity inflow in the manufacturing sector alone has surged by 69 percent over the past decade, rising from US$98 billion (2004-2014) to US$165 billion (2014-2024).

Key industries under the PLI scheme have also registered an increase in export activities. For instance, India’s mobile phone manufacturing sector has shifted from being a net importer to a net exporter, with domestic production surging from 58 million units in FY 2014-15 to 330 million units in FY 2023-24. Similarly, the domestic pharmaceutical industry has strengthened its global presence, with 50 percent of production now being exported and key bulk drugs being manufactured locally.

Source: India Briefing

Comments